Unlocking the future with simulation

Aindo's new predictive capacity turns historical data into actionable foresight

At Aindo, we believe the power of synthetic data goes beyond privacy. It enables organizations to explore new possibilities safely, quickly, and at scale.

With our latest update, we’re taking this vision further: you can now run simulations directly on your data using our Python library and APIs. This new functionality extends synthetic data generation into predictive modeling - projecting possible futures, not just replicating the present.

What is simulation?

Simulation is about exploring what could happen next. Instead of producing a single-point prediction, Aindo’s generative models provide full probability distributions of possible outcomes. This reveals not only expected trends, but also risks, uncertainties, and rare edge cases.

With simulation, you can:

- Run what-if scenarios – test how systems behave under different assumptions.

- Perform sensitivity analysis – see how small changes in one factor ripple across outcomes.

- Understand uncertainty – work with probability distributions, not just averages.

Our prediction functionality allows you to perform predictive analysis directly on relational data, without requiring manual transformation (feature engineering) or flattening complex database structures. The generative models learn the relationships between variables across multiple tables and time series, enabling contextualized, high-fidelity forecasts. This functionality also allows the simulation of scenarios (what-if analysis), useful for evaluating the impact of different initial conditions on the extrapolations themselves.

Main capabilities include:

- Modeling on relational data: contextual forecasts without the need for manual feature engineering or data flattening.

- Trend extrapolation: analysis of multi-table historical data for accurate temporal projections.

- What-if scenarios: Trend extrapolation can also be performed in “what-if” mode, allowing the simulation of hypothetical events.

And because Aindo’s models work natively on relational data, you can do all of this without flattening complex databases or spending weeks on feature engineering.

Example use cases

Simulation can be used for a variety of use cases, for example:

Healthcare: simulate the probability of hospital readmission across demographics, assess disease progression risks, or plan preventive care campaigns with confidence.

Finance: calculate portfolio Value at Risk (VaR), project ROI under different market conditions, or stress-test strategies across 100,000 scenarios.

Retail & beyond: estimate the impact of promotions, simulate customer churn if prices change, or forecast logistics needs after marketing campaigns.

A closer look: Finance simulation example

To illustrate how this works in practice, let’s take a portfolio forecasting example.

For this demonstration, we will use the well-known Berka and Sochorova dataset, a financial dataset containing more than 4,500 accounts and about one million transactions up until 1999. Each account can be modeled as an event series, where each transaction is an event in time.

We train our model directly on this relational data, without flattening tables or spending weeks on manual feature engineering. Instead, the model automatically learns the relationships between variables and tables, preserving contextual patterns in the data. Once trained, the generator can continue a sequence of events, predicting what the next event might be given the historical context.

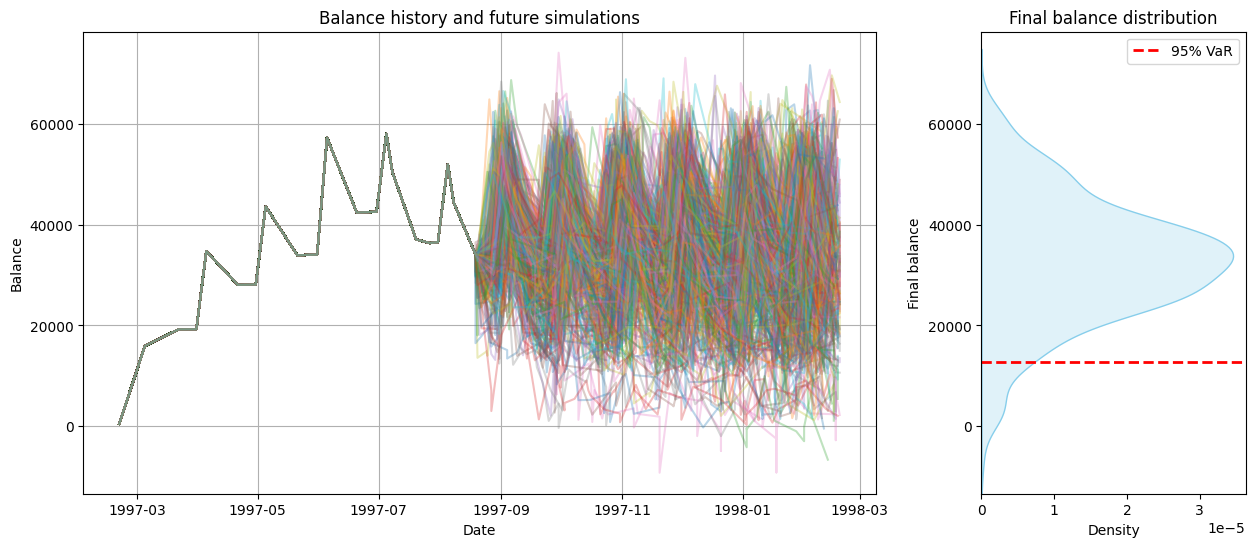

Suppose we want to estimate a particular account’s balance six months in the future. We take the first six months of transactions of this account as context, and then ask Aindo’s model to generate 500 possible continuations of the account’s activity over the following six months. The system extrapolates these transaction series into the future, producing probabilistic forecasts rather than a single deterministic outcome.

The result is 500 realistic synthetic “future scenarios,” each showing how the balance might evolve over time. At the six-month cut-off point, we now have 500 data points forming a probability distribution of possible portfolio values. This distribution can then be used for further scenario analysis or risk metrics, such as Value at Risk (VaR).

Example of portfolio forecasting with Aindo’s prediction module. Starting from six months of transaction history, the

model generates 500 synthetic continuations of account activity. The resulting probability distribution of balances

after six months provides a contextual basis for scenario analysis and risk metrics such as Value at Risk (VaR).

Example of portfolio forecasting with Aindo’s prediction module. Starting from six months of transaction history, the

model generates 500 synthetic continuations of account activity. The resulting probability distribution of balances

after six months provides a contextual basis for scenario analysis and risk metrics such as Value at Risk (VaR).

From this distribution, we can calculate financial risk metrics like Value at Risk (VaR). For instance, a 95% VaR tells us the amount below which the portfolio could fall with a 5% probability over six months. You will now have a distribution of outcomes to guide strategy and risk management.

Trend exploration and what-if scenarios

Aindo’s new predictive capacity enables organizations to predict future trends based on historical data. Our generator trained on past data can provide accurate and contextually relevant forecasts. Since the forecast is performed on complex structured data, information in a variety of formats can be included in the extrapolations.

Beyond forecasting, the module supports what-if scenarios, allowing you to test hypothetical events and evaluate their impact. The workflow includes:

- Contextual learning: The system analyzes multi-table historical data (e.g., sales, customer behavior, macroeconomic indicators), identifying non-linear relationships and temporal dependencies.

- Scenario generation: Based on probabilistic models, it produces realistic projections (e.g., “How would customer churn rate change if prices were increased by 10%?”).

- Sensitivity analysis: Evaluates the impact of individual variables (e.g., the effect of a marketing campaign on specific demographic segments)

Ready to explore the future of your data?

Aindo’s new predictive capacity gives organizations a richer understanding of uncertainty and risk, and a safe, flexible, and powerful way to look ahead. It is available now via our API and Python library, with full documentation.

Get in touch with us today to see how simulation can accelerate your AI journey.